Why did Gree sell Gree? The change of control rights ushered in new progress.

Wen | Biange @ Shijin Institute

Gree Electric’s control rights change ushered in new progress!

On the evening of April 8, Gree Electric announced that Gree Group intends to transfer 15% of the total share capital of Gree Electric held by Gree Group through public solicitation of transferees.

After the transfer is completed, the controlling shareholder and actual controller of Gree Electric may change. On April 9, Gree Electric resumed trading, and the daily limit was directly increased after the opening.

Information shows that Gree Electric landed on the main board of Shenzhen Stock Exchange in 1996. After listing, Gree Group has been the controlling shareholder, and the actual controller is Zhuhai SASAC. In 2004, Zhu Jianghong, then the chairman of Gree Electric, said that Gree Electric would introduce strategic investors instead of monopolizing state-owned shares.

In March 2006, Gree Electric started the share-trading reform, and the shareholding ratio of Gree Group decreased to 41.06%. By realizing the circulation of state-owned shares, Gree Group set aside some shares from its holdings as the stock source of Gree Electric management’s equity incentive plan.

In order to introduce the dealer alliance into the company’s strategic investors, Gree Group transferred part of its equity to Hebei Jinghai Guarantee Investment Co., Ltd., which is the shareholder of Gree Electric’s major dealers. These measures have reduced the shareholding ratio of Gree Group.

Gree Electric’s 2010 annual report shows that Gree Group holds 1.096 billion shares, with a shareholding ratio of 18.22%. Subsequently, it has been maintained at this shareholding number and shareholding ratio.

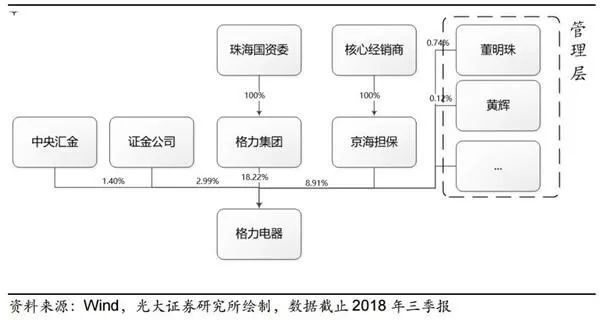

Gree Electric’s third quarterly report in 2018 shows that apart from Gree Group, the second largest shareholder among the top ten shareholders is Hebei Jinghai Guarantee Investment Co., Ltd., which is owned by the main distributor in Gree Electric and holds 8.91% of the shares in Gree Electric. The third to ninth shareholders are all institutional investors, and the tenth largest shareholder is Dong Mingzhu, with a shareholding ratio of 0.74%.

If the transfer of shares is successful, the proportion of shares held by Gree Group in Gree Electric will drop to 3.22%, and it will still rank among the top 10 shareholders.

By 2018, the total operating income of Gree Group is expected to exceed 200 billion yuan, the net profit exceeds 26 billion yuan, and the net profit attributable to state-owned shareholders exceeds 4 billion yuan, up by 33.37%, 19.15% and 12.90% respectively. Among them, Gree Electric made a great contribution.

According to Gree Electric’s performance forecast, in 2018, Gree Electric is expected to achieve operating income of 200 billion to 201 billion yuan, a year-on-year increase of more than 33.33%; It is estimated that the net profit will be 26-27 billion yuan, a year-on-year increase of 16%-21%.

In addition, Gree Electric pays large dividends almost every year. Since its listing in 1996, Gree Electric has paid dividends for 19 times, with a cumulative dividend of 41.8 billion yuan, with a dividend rate of 40.65%. Statistics show that after listing, Gree Group received more than 8.8 billion yuan in dividends from Gree Electric.

In fact, this sale plan of Gree Group makes investors quite puzzled. With low valuation, sufficient cash flow and high profit level, Gree Electric is a high-quality "white horse stock" envied by everyone in the capital market. For the major shareholder Gree Group, it is definitely a quality asset. Then, why did Gree Group sell the equity of Gree Electric and give up its controlling position?

(1) Liquidating funds and investing in other projects

According to the announcement issued by Gree Electric on April 8, equity transfer price is not lower than the arithmetic average of the daily weighted average price in the 30 trading days before April 9, and the final transfer price is subject to the result of public solicitation and approval by the state-owned assets supervision and administration department.

According to the average share price of 45.59 yuan/share in the 30 trading days before April 9, the market value of Gree Electric’s 15% equity is about41.1 billion yuan.

If the equity transfer plan goes smoothly, Gree Group will recover more than 40 billion yuan in one time, accounting for one-third of Zhuhai’s fiscal revenue in 2018.

According to public information, Gree Group was founded in March 1985 and has grown into the largest and most powerful state-owned leading enterprise in Zhuhai, covering manufacturing, financial investment, construction investment, construction and installation, and island tourism.

Gree Group owns more than 20 companies, including Gree Electric, Gree New Technology, Zhuhai Jian ‘an Group, Gree Energy Trade, Gree Aviation Investment, Gree Petrochemical and Gree Finance.

Official website, Gree Group, said that it will deepen the strategic pattern of "one core and four pillars" around the goal of "building a domestic first-class comprehensive enterprise driven by investment and innovation" and create a new situation of "second venture" with greater achievements.

2018 is the foundation year of Gree Group’s "second venture". At the 2019 work conference held by Gree Group in January 2019, Zhou Lewei, chairman of Gree Group, proposed that in the work of 2019, we should actively promote all work to make bright spots and show the new image of Gree Group’s "second venture".

For the huge amount of money harvested after the sale of Gree’s equity, Gree Group can not only increase its capital, but also set up industrial funds to invest in other potential industries.

In addition, on April 1st, after the central government lowered the value-added tax, the fiscal revenue of the Pearl River City may be compressed, and the sale of Gree shares can also supplement some government coffers.

(2) conform to the trend of mixed reform of state-owned enterprises

In fact, as early as 2013, the National Development and Reform Commission issued a document to support private enterprises and foreign enterprises to acquire holding state-owned enterprises. The so-called mixed reform (mixed ownership reform of state-owned enterprises) is to add private (unofficial) capital to the state-controlled enterprises, making the state-owned enterprises become multi-holding, but still state-controlled enterprises to participate in market competition. The ultimate goal of mixed reform is to make the state-owned enterprises more competitive and dynamic in the reform and make the governance system of state-owned enterprises more in line with the modern corporate governance mechanism.

In October 2018, the central government successively issued a number of policies to promote mixed reform. the State Council, the State-owned Assets Supervision and Administration Commission, and local governments successively issued policies to allow private enterprises to participate in shares, even holding state-owned enterprises, without setting an upper limit on the shareholding ratio. In January 2019, the State-owned Assets Supervision and Administration Commission (SASAC) once again clearly put forward the policy of supporting mixed reform.

It is against this background that the controlling rights of many state-owned listed companies have changed recently. For example, the actual controller of Zhongju Gaoxin was changed to Yao Zhenhua of Baoneng Department, and the actual controller of Hanshang Group was changed from Wuhan SASAC to Yan Zhi, a natural person.

Facing the trend of mixed reform of state-owned enterprises, it is the general trend for Gree Group and Zhuhai Municipal Government to promote the reform of mixed ownership in Gree Electric.

Specifically, the strategic reduction of Gree Electric by Zhuhai State-owned Assets Supervision and Administration Commission is a key measure to promote the reform of state-owned enterprises to "manage capital", which has reference significance for Guangdong Province and even the whole country to further implement the reform of mixed ownership of state-owned enterprises.

In September 2018, the State-owned Assets Supervision and Administration Commission of Zhuhai issued a guiding opinion on improving the quality of state-owned enterprises, proposing to steadily implement the reform of mixed ownership, taking diversification of property rights and introducing strategic investors as a breakthrough to promote the mixed reform of municipal enterprises.

On the timetable, this opinion pointed out that by 2021, the coverage rate of mixed ownership reform of Zhuhai municipal enterprises at all levels should reach more than 70%, and 2-3 mixed reforms will be implemented at the group level, and 2-3 listed companies will participate in investment in advanced manufacturing industries.

Gree Electric is a commercial state-owned enterprise in fully competitive industries and fields, and it is also a very famous high-quality asset, so it is of great significance to mix and reform it.

The reform of mixed ownership will make Gree Electric truly realize the transformation from mixed ownership to reform. By introducing strategic investors, three system reforms will be further promoted in the process of mixed ownership reform, and market-oriented selection and employment and incentive and restraint mechanisms will be established, which will help Gree Electric to establish an effective corporate governance structure with checks and balances and a flexible and efficient market-oriented operating mechanism.

As one of the earliest four special economic zones in China, Zhuhai’s move of "returning and bringing in" will not only conform to the deepening situation of state-owned enterprise reform, but also strongly promote the transformation of government image and the "second venture" of Zhuhai’s economy. In this process, Gree Electric is expected to lead a new round of mixed reform in Zhuhai.

(3) The control right of Zhuhai SASAC has already been weakened.

From the perspective of shareholding structure, Gree Group is the largest shareholder in Gree Electric, with a shareholding ratio of 18.22%, and Dong Mingzhu personally holds 0.74% of Gree Electric, making it the tenth largest shareholder in Gree Electric.

However, for a long time, the control right of Zhuhai SASAC over Gree Electric has been greatly weakened. Under such circumstances, it is understandable that Gree Group "has" backed out.

Since Dong Mingzhu took charge of Gree, the wrestling between Dong Mingzhu and Zhuhai SASAC, the major shareholder of Gree Group, has been going on.

In May 2012, when Zhu Jianghong stepped down as the chairman of Gree Group and Gree Electric, Dong Mingzhu took over as the chairman of Gree Group, but Zhuhai SASAC appointed Zhou Shaoqiang, the former deputy director of SASAC, as the party secretary and president of Gree Group, and nominated him as the director of Gree Electric.

According to the conventional script, Zhou Shaoqiang will be the chairman of Gree Electric, but he failed to pass the election of the board of directors and only got 36.6% of the votes.

In January 2013, it was revealed that Zhou Shaoqiang spent 12 bottles of red wine in a luxury club, and was removed from the leadership position of Gree Group.

In October 2016, the State-owned Assets Supervision and Administration Commission of Zhuhai dismissed Dong Mingzhu as the chairman, president and legal representative of Gree Group on the grounds that the chairman of the listed company and its affiliated group could not serve concurrently.

The fierce control struggle is coming to an end in 2018, and the newly appointed Zhuhai Municipal Party Committee Secretary said, "I hope Dong Mingzhu will lead the young Gree to continue to create brilliant achievements".

On January 16th, 2019, the list of the new board of directors of Gree Electric was finally released. This time, there were 9 directors, 2 more than the previous one. Among them, there are still three independent directors, namely Liu Shuwei, Xing Ziwen and Wang Xiaohua. The number of non-independent directors increased from 4 to 6, namely Dong Mingzhu, Huang Hui, Wang Jingdong, Zhang Wei, Zhang Jun Governor and Guo Shuzhan.

Almost all of these six non-independent directors come from the senior management of Gree Electric, among which Gree Group, the major shareholder of Gree Electric, has acquired four directors, namely Dong Mingzhu, Huang Hui, Wang Jingdong and Zhang Wei. Huang Hui is the CEO of Gree Electric, Wang Jingdong is the vice president, financial controller and secretary of the board of directors of Gree Electric, and Zhang Wei is currently the executive vice president of Gree Group.

The other two non-independent directors, Governor Zhang Jun and Guo Shuzhan, are also the backbone of the Gree Electric dealer system built by Dong Mingzhu. Such a list once again ensures Dong Mingzhu’s controlling position in Gree Electric.

According to the shareholder information of Gree Electric, the current shareholding ratio of Gree Group, the controlling shareholder, is 18.22%. After the transfer of 15%, Gree Group will continue to hold 3.22% of the shares.

According to Gree Electric’s Articles of Association, shareholders holding more than 3% of shares have the right to nominate directors. Gree Group shares still left 3.22% after the transfer of shares, which may be related to this relevant regulation. In this way, in the corporate governance structure of Gree Electric in the future, Zhuhai SASAC will still retain certain right to speak and make business decisions.

It is worth noting that the retention of shares and the right to nominate seats on the board of directors echo the revision of Gree Electric’s Articles of Association in early 2019. On January 2, 2019, Gree Electric revised the Articles of Association, adding two institutions: the Party Committee and the Commission for Discipline Inspection.

The second, third, fourth and fifth largest shareholders in Gree Electric’s shareholding structure are Hebei Jinghai Guarantee Investment Co., Ltd., with a shareholding ratio of 8.91%; Hong Kong Securities Clearing Company Limited (Land Stock Connect) holds 7.86%; China Securities Finance Co., Ltd. holds 2.99%; Qianhai Life Insurance Company Limited — — Haili holds 1.92% every year.

If 15% of Gree Group’s shares are transferred to a single strategic investor, then Gree Group will become the fifth largest shareholder. Looking back, the reason why Gree Group set up two new governance institutions in early 2019 may be to consider maintaining the influence of Zhuhai SASAC beyond the shareholding ratio.

If you like this article, you can see more stocks, disk trend analysis and investment skills on Moore Financial APP or moer.cn, the official website of Moore Financial, and you can also search for Moore Financial on Sina Weibo, WeChat WeChat official account and today’s headlines and pay attention to it.