Xiaomi SU7 Ultra is priced at 814,900 yuan, which is against Ferrari.

On October 29th, 2024, Xiaomi Company officially released its first high-performance four-door racing car-SU7 Ultra. This model quickly attracted the attention of the market with a pre-sale price of 814,900 yuan, and the scheduled quantity exceeded 3,680 units in just 10 minutes, showing consumers’ eager expectation for its powerful performance. Lei Jun, the founder of Xiaomi, emphasized the company’s attention and investment in the field of intelligent driving at the press conference, indicating that Xiaomi is not only committed to building high-performance cars, but also hopes to take the lead in intelligent driving technology.

This report will deeply analyze the technical characteristics, market positioning and potential impact of Ultra in the automobile industry, discuss how it challenges the market position of traditional luxury brands, and look forward to the performance of the future production version. Through a comprehensive interpretation of Xiaomi SU7 Ultra, we will reveal its importance in the high-end electric vehicle market and its appeal to consumers.

Performance characteristics of Xiaomi SU7 Ultra

Xiaomi SU7 Ultra is a high-performance electric car that has attracted much attention, and it showed amazing performance parameters at the press conference. The car is equipped with a super motor system developed by Xiaomi, with a maximum horsepower of 1,548 horsepower. It adopts a three-motor layout, including two V8s motors and one V6s motor, which ensures a strong power output. In terms of acceleration performance, the acceleration time of SU7 Ultra from zero to 100 kilometers is only 1.98 seconds, which is in a leading position among similar models and shows its excellent acceleration ability.

In addition, the top design speed of Xiaomi SU7 Ultra exceeds 350 km/h, which gives it a significant advantage when competing with other high-performance electric vehicles in the market. Lei Jun stressed at the press conference that this car is not only a four-door racing car that can legally go on the road, but also aims to become the fastest four-door production car on the surface. The performance at the New North Circuit also confirmed this point.The SU7 Ultra prototype set a new lap time record for the four-door car with a time of 6 minutes, 46 seconds and 874 seconds, becoming the fastest four-door car in the history of New North.

In terms of market competitiveness, Xiaomi SU7 Ultra is priced at 814,900 yuan. Although it is not cheap in the high-performance electric vehicle market, its performance and technical configuration make it quite cost-effective. Compared with the high-performance models of Tesla and other brands, SU7 Ultra has performed well in acceleration and top speed, and its unique design and brand effect have attracted a lot of consumers’ attention, and the booking volume has exceeded 3,680 units in a short time.

Generally speaking, with its powerful power system, excellent acceleration performance and market competitiveness, Xiaomi SU7 Ultra shows its ambition and strength in the field of electric vehicles, and indicates its potential and development direction in the high-performance electric vehicle market in the future.

Design concept of Xiaomi SU7 Ultra

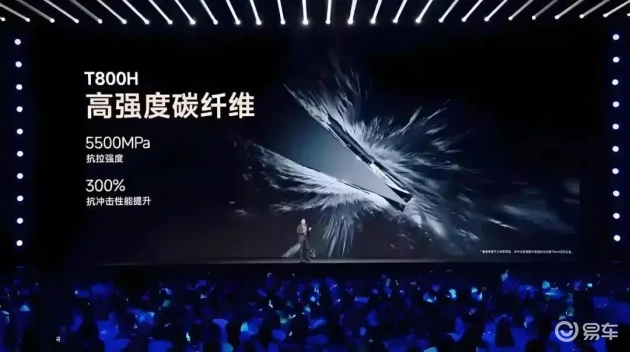

The design concept of Xiaomi SU7 Ultra reflects Xiaomi’s innovation in the automotive field and its determination to pursue the ultimate performance. First of all, in terms of design, SU7 Ultra adopts a streamlined body structure, which combines the sense of movement and technology to show a futuristic beauty. The use of carbon fiber materials in many parts of the car body not only reduces the weight of the car, but also improves the overall rigidity and safety. This design is not only for beauty, but also for better handling performance and acceleration on the track.

In terms of interior configuration, Xiaomi SU7 Ultra also spared no effort. The car is equipped with a high-end intelligent driving system, combined with Xiaomi’s self-developed intelligent driving technology, providing an extremely convenient user experience. The seats in the car are ergonomically designed to ensure the comfort during long-term driving. In addition, the car is equipped with a high-power sound system, which can play simulated sound waves and enhance the fun of driving.

In terms of user experience, Xiaomi SU7 Ultra is not only a high-performance racing car, but also a technology car that can legally go on the road. Xiaomi hopes to attract more young consumers and satisfy their dual pursuit of speed and technology.

Xiaomi’s Investment in Intelligent Driving

Xiaomi’s investment and development plan in the field of intelligent driving is gradually showing its ambition. According to Lei Jun, the goal of Xiaomi Automobile is to enter the first camp of intelligent driving by the end of 2024. The realization of this goal depends on its continuous investment and innovation in technology research and development. Xiaomi has made several rounds of investment in intelligent driving technology. The total investment in the first phase increased from 3.3 billion yuan to 4.7 billion yuan, and the scale of the exclusive team exceeded 1,000.

In terms of technological progress, Xiaomi’s intelligent driving system has realized the function of urban navigation assisted driving (NOA), and plans to start full push on October 30, 2024. This system is equipped with an end-to-end big model and a visual language big model, aiming at realizing the automatic driving experience of "parking space to parking space", and users can use it just by getting on the bus. In addition, Xiaomi continues to iterate its intelligent driving technology, and recently launched a number of OTA upgrades, further improving the intelligent level of vehicles.

Xiaomi’s smart driving strategy is not limited to the research and development of technology, but also includes the layout of the market and the improvement of user experience. Lei Jun emphasized that intelligent driving is a competitive highland for intelligent automobiles, and Xiaomi will continue to increase its investment in this field to ensure a favorable position in future market competition. After the launch of SU7, the first mass-produced model of Xiaomi Automobile, the delivery volume quickly broke through, showing the market’s recognition and expectation for its intelligent driving technology.

In the future, Xiaomi plans to continue to expand its technical capabilities in the field of intelligent driving, strive to achieve a higher level of autonomous driving function in the next few years, and further consolidate its position in the smart car market. Through continuous technological innovation and market expansion, Xiaomi hopes to compete with industry leaders such as Tesla in the field of intelligent driving, and finally achieve its goal of becoming the top five automobile manufacturers in the world.

Comparison between Xiaomi SU7 Ultra and its competitors

Xiaomi SU7 Ultra is defined as a "peak performance technology car", and its goal is to break the boundaries of the traditional automobile market and challenge the leaders of the high-end electric vehicle market. Xiaomi’s strategy is to become the top five automobile manufacturers in the world in the next 15 to 20 years, and the realization of this goal will depend on the market performance of high-performance models such as SU7 Ultra.

Compared with other high-performance electric vehicles such as Tesla Model Slaid, Xiaomi SU7 Ultra performs well in acceleration performance. The acceleration time of Tesla Model Slaid is 1.99 seconds. Although it is similar to Xiaomi SU7 Ultra, the starting price of Tesla is usually higher than 800,000 yuan in price, and Tesla still occupies a leading position in brand recognition and market share. The launch of Xiaomi SU7 Ultra marks the further layout of Xiaomi in the electric vehicle market, especially in the field of high-performance electric vehicles.

However, Xiaomi SU7 Ultra also faces some disadvantages. First of all, as a new entrant, Xiaomi has relatively insufficient experience in automobile manufacturing and marketing, which may affect its market performance. Although Xiaomi has accumulated rich experience in the field of smart phones, the complexity and fierce competition of the automobile industry far exceeds that of the mobile phone market. Secondly, although the performance parameters of Xiaomi SU7 Ultra are impressive, it still takes time for consumers to build their trust and awareness of the brand, especially in the high-end market. Consumers tend to choose brands with a long history and good reputation.

In addition, the market performance of Xiaomi SU7 Ultra is also affected by the overall electric vehicle market environment. With the rapid development of the electric vehicle market, competitors such as Weilai and Ideality are constantly introducing new models to compete for market share. Xiaomi needs to make continuous efforts in product quality, after-sales service and brand image to enhance its market competitiveness.

Generally speaking, Xiaomi SU7 Ultra has shown strong competitive potential in the high-performance four-door electric vehicle market with its excellent performance and relatively reasonable pricing, but its lack of brand recognition and market experience may become an obstacle to its further development.

Generally speaking, Xiaomi’s brand strategy in the automobile market aims to enhance its brand image and expand its market share through the launch of high-performance models and continuous technological innovation. The successful release of SU7 Ultra not only laid the foundation for Xiaomi Automobile, but also provided strong support for its future market expansion plan.